The insurance industry is quickly evolving as technology advances and consumer expectations shift, completely changing the way insurance products are marketed and sold. But what does this mean for non-insurance businesses and software platforms? There’s always been demand from customers looking to protect their purchases, it’s just never been quite as convenient as it is today. This guide takes a closer look at how embedded insurance compares to traditional distribution channels and why it matters for your platform.

What is embedded insurance?

Embedded insurance is an emerging distribution model where insurance products are seamlessly integrated into the purchase process of non-insurance products or services. For example, when booking a hotel, travelers can opt for travel insurance at checkout, or when purchasing event tickets, buyers can add refund protection.

What are some of the other distribution models?

- Direct-to-Consumer (D2C): In this model, insurers sell products directly to customers via digital platforms, such as websites and mobile apps. Although this method gives consumers direct access to purchase products at their convenience, it also relies heavily on costly marketing strategies to drive traffic and typically requires lengthy applications before purchase.

- Brokerage and Agency: Brokers act as intermediaries between buyers and insurers, providing personalized advice to customers. Agents typically represent insurers – working exclusively for one insurer or for multiple insurers. Because both are paid commission, this model makes the most sense for more traditional policies with higher premiums.

- Affinity Marketing: Here, insurers partner with organizations or associations to offer insurance products to specific groups of individuals who share common characteristics. While this model allows businesses to offer more personalized insurance products, the purchase process can be disjointed, featuring pop-outs to external sites with a separate application and payment.

How does embedded insurance differ?

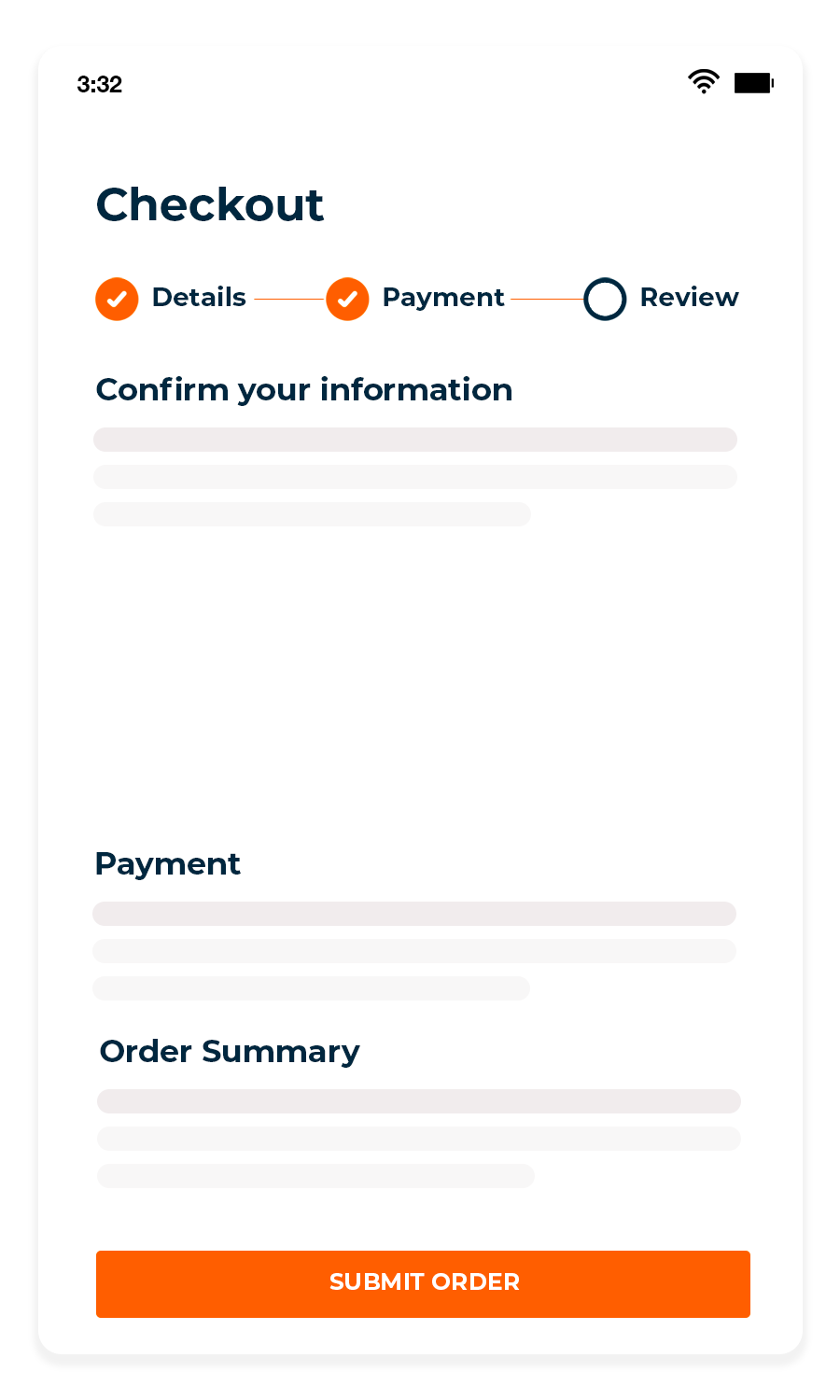

- Seamless Integration: Embedded insurance is integrated directly into the purchase journey, offering insurance as a natural part of the transaction. This seamless integration reduces friction and makes it easier for customers to add coverage without needing to engage in a separate insurance-buying process.

- Personalization: Because customers have already entered their basic information during the purchase process, each insurance offer can be highly personalized and tailored to the specific product or service the customer is purchasing. This increases the relevance of the insurance offer, making it more appealing and likely to be accepted.

- Enhanced Customer Experience: By embedding insurance into the purchase process, platforms can offer a more cohesive and satisfying customer experience. Customers appreciate the convenience and simplicity of adding coverage at the point of sale, knowing their investments are protected.

- New Revenue: The convenience of purchasing insurance at the point of sale often leads to higher conversion rates. Customers are more likely to opt for insurance when it is presented as an add-on to a purchase they are already making through a platform they already trust. In turn, this also adds revenue for platforms who are paid for every policy sold and significantly reduces refund requests.